46+ debt-to-income ratio for mortgage wells fargo

Connect with a reverse mortgage lender now to see if you qualify with a free consultation. A DTI ratio in the 36 to.

Calculating Your Debt To Income Ratio

Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680.

. Apply Online Get Pre-Approved Today. Web For example if you pay 500 toward your credit cards each month 800 for your student loan and 2400 for your mortgage your total monthly debt is 3700. Ad Compare Best Mortgage Lenders 2023.

Web Your debt-to-income ratio tells you how much of your income is spoken for For example if 35 of your monthly earnings go toward debt payments you only have. Web Your debt-to-income ratio is an important measurement that lenders use to judge your creditworthiness. Web For example if you earn 4000 per month and your debt payments total 2000 per month comprised of 1000 in existing student loans and 1000 for your.

Web What is a Debt-to-Income Ratio. Apply Now With Quicken Loans. Web The debt-to-income DTI ratio is the percentage of your gross monthly income that goes to paying your monthly debt payments and is used by lenders to.

These rates are highly competitive with those offered by other lenders especially for. Web Wells Fargo publishes a list of its current mortgage rates updated daily. Web Deposit products offered by Wells Fargo Bank NA.

Ad Get an Affordable Mortgage Loan With Americas 1 Online Lender. Use a DSCR loan to purchase investment property without using personal income to qualify. Ad NASB is a Debt Service Coverage Ratio mortgage lender.

Web Your front-end or household ratio would be 1800 7000 026 or 26. Ad A reverse mortgage gives you the power to unlock your homes equity while you live in it. Practice Management Group and Milestone programs and support.

Web Wells Fargo says this shows your debt is at a manageable level and that you have plenty of money left over once your bills are paid. Ad Get an Affordable Mortgage Loan With Americas 1 Online Lender. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Apply Now With Quicken Loans. It looks at your monthly debt obligations in relation to how. To get the back-end ratio add up your other debts along with your housing expenses.

Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on. Choose The Loan That Suits You. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Be Confident Youre Getting the Right Mortgage. All financing is subject to credit approval. Get All The Info You Need To Choose a Mortgage Loan.

Be Confident Youre Getting the Right Mortgage.

Calculate Your Debt To Income Ratio Wells Fargo

Covid 19 Mortgage Forbearances Drivers And Payment Behavior The Journal Of Structured Finance

Uvb 1io4li Tem

Education Sector Analysis Methodological Guidelines Vol 2 Sub Sector Specific Analysis

How Debt To Income Ratio Dti Affects Mortgages

Mortgage How Much Can You Borrow Wells Fargo

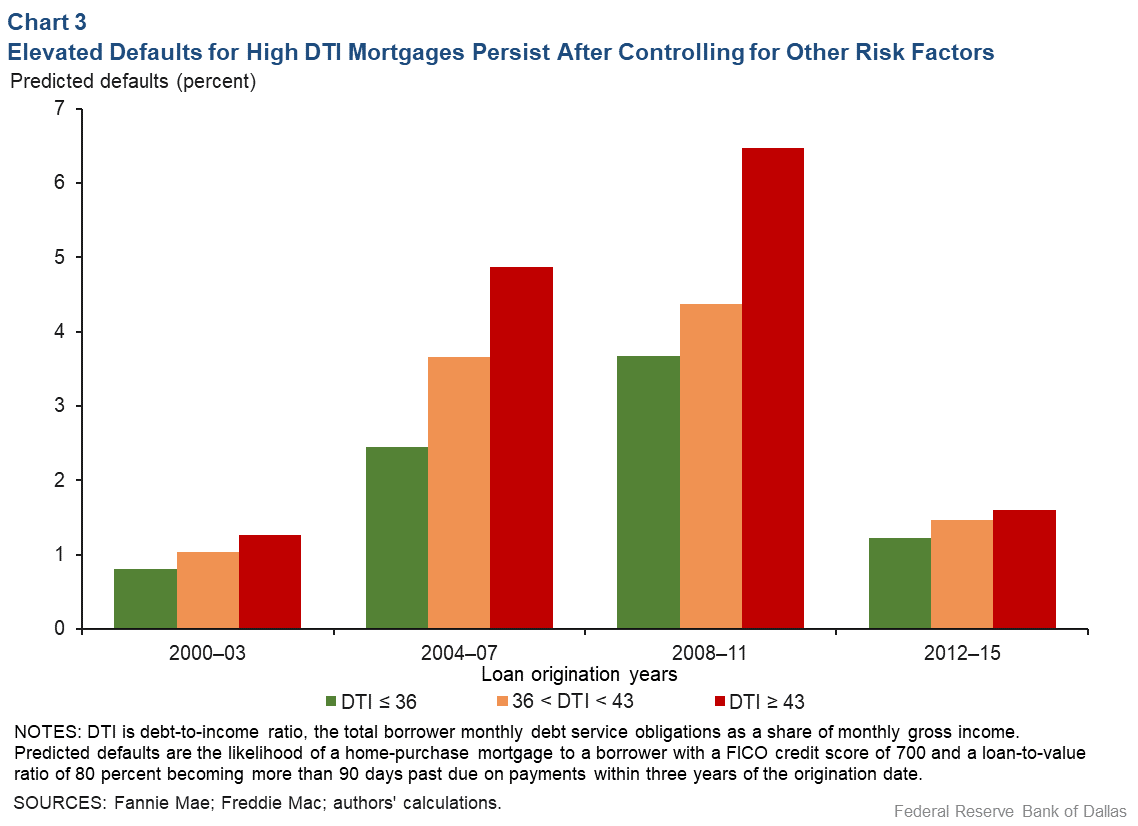

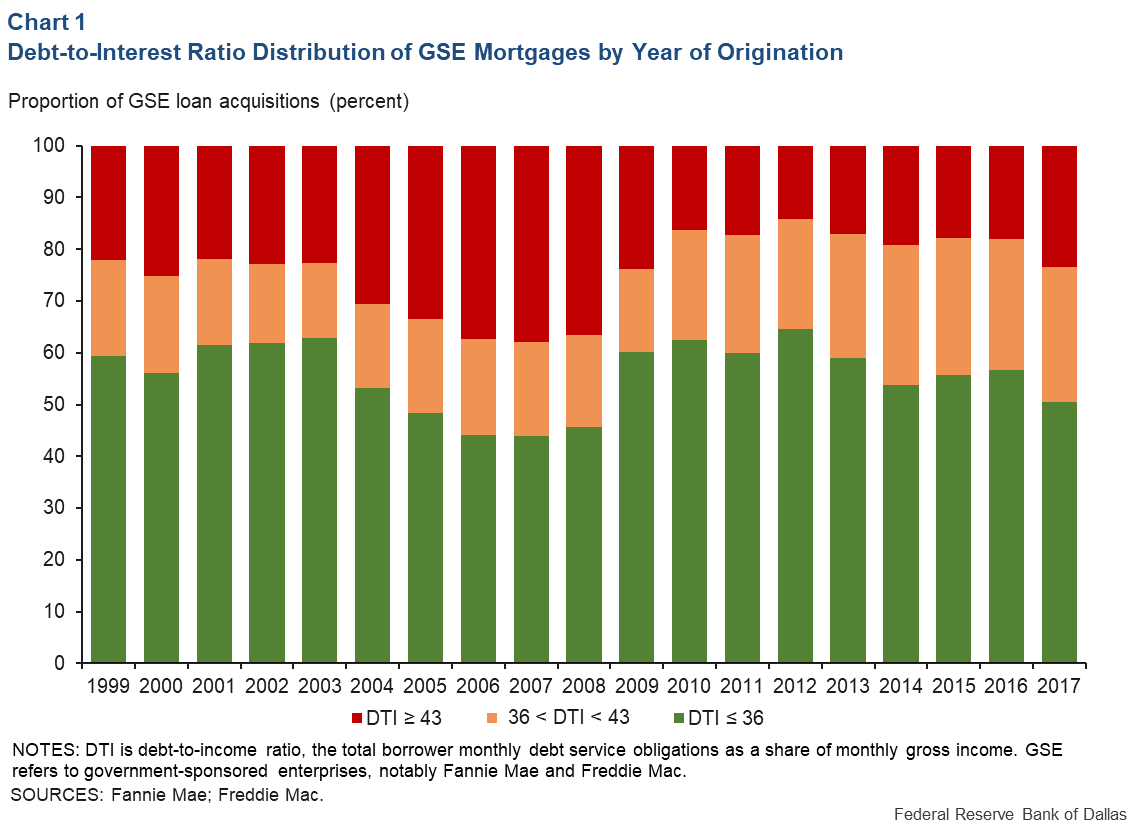

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

What Is The Debt To Income Ratio Learn More Citizens Bank

.png?width=600&name=understanding-debt-to-income-ratio-(new).png)

Calculating Your Debt To Income Ratio

How To Calculate Debt To Income Ratio For Mortgage More Mmi

Wells Fargo Bank Of America Quicken Loans Others Want Dti Requirement Eliminated From Qm Lending Rules Housingwire

Covid 19 Mortgage Forbearances Drivers And Payment Behavior The Journal Of Structured Finance

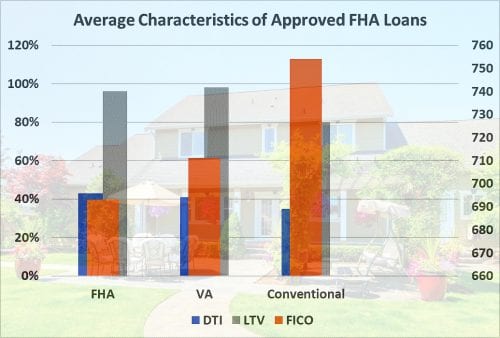

Guide To Fha Home Loans How Much Income Do You Need Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

Covid 19 Mortgage Forbearances Drivers And Payment Behavior The Journal Of Structured Finance

![]()

Common Questions About Debt To Income Ratios Wells Fargo

How To Get A Loan With A High Debt To Income Ratio 2023