30+ How much can j borrow mortgage

Latest from HM Treasury. If you have no existing balance you can borrow up to 85 of your homes total value.

G816834 Jpg

As of Mar.

. 30 Similarly the. On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602. The company pioneered the use of commercial paper for entrepreneurs and joined the New.

Rental income of 1000 per month. Liz Truss can now show what shes capable of. To get the process started the scammer asked for a few sheets of the companys letterhead bank account numbers and other personal.

In exchange for transferring the funds out of Nigeria the recipient would keep 30 of the total. Learn more about how much a 300000 mortgage will cost you in the long run. How to borrow from home equity.

After the period is over the ownership of the house is transferred to. Money Under 30 has created a mortgage pre-approval calculator that can help you understand how much you can really take out to buy a home. Average interest rates by month for home equity conversion mortgages HECMs.

Power the NAIC AM Best SP and Moodys to determine. If you didnt have a paid-off house and your mortgage was say 150000 youd only be able to access 190000 400000 x 85 150000. You can also look at third-party scores from JD.

Between 2014 and 2018 Bloomberg had a true tax rate of 130. On a home worth 400000 for example thats equal to a lump-sum payment of up to 340000 400000 x 85. Most homebuyers choose a 30-year fixed-rate mortgage but a 15-year mortgage can be a good choice too.

In 1885 Goldman took his son Henry and his son-in-law Ludwig Dreyfuss into the business and the firm adopted its present name Goldman Sachs Co. Home Equity Conversion Mortgage - HECM. This period during the run up to.

Where to get a 300000 mortgage. Home Equity Conversion Mortgages allow seniors to convert the equity in their home. In a statement a spokesman for Bloomberg noted that as a candidate Bloomberg had advocated for a variety of tax hikes on the wealthy.

How much you can borrow will depend on factors such as your credit score income. 6 July 2022 News story. In 1882 Goldmans son-in-law Samuel Sachs joined the firm.

There are also ongoing costs with a mortgage. Quantitative easing QE is a monetary policy whereby a central bank purchases predetermined amounts of government bonds or other financial assets eg municipal bonds corporate bonds stocks etc in order to inject money into the economy to expand economic activity. Tax cut worth up to 330 comes in for 30 million workers.

Telegraph View 4 Sep 2022 1000pm. Goldman Sachs was founded in New York City in 1869 by Marcus Goldman. The borrower actually pays almost 22 times more interest to borrow the same amount of.

As of September 6 2022 the jumbo 30-year fixed mortgage rate is 527 and the jumbo 15-year rate is 527. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. What to consider before applying for a 300000 mortgage.

Boris Johnson is a prime minister worth learning from. The piggyback second mortgage can also be financed through an 8020 loan structure. How Much Can You Borrow with a Reverse Mortgage.

That said it may still make sense to pay the full 20 of the homes purchase price if possible. A type of Federal Housing Administration FHA insured reverse mortgage. How much you can afford to borrow depends on a number of factors not just what a bank is willing to lend you.

You can start with this mortgage preapproval calculator. Todays mortgage rates. The idea of a 20 down payment can make homeownership feel unrealistic but the good news is that very few lenders still require 20 at closing.

That was budgeted but was never spent. You can find supporting and related documents below. Telegraph View 5 Sep 2022 1000pm.

Waterloo is a city in the Canadian province of OntarioIt is one of three cities in the Regional Municipality of Waterloo formerly Waterloo CountyWaterloo is situated about 94 km 58 mi southwest of TorontoDue to the close proximity of the city of Kitchener to Waterloo the two together are often referred to as KitchenerWaterloo or the Twin Cities. The more common of the two is the 801010 mortgage arrangement in which the home buyer is granted an 80 percent loan-to-value LTV on the primary mortgage and 10 percent LTV on the second mortgage with a 10 percent down payment. Quantitative easing is an unconventional form of monetary policy which is usually used when inflation is.

Here a house that the senior citizen owns is mortgaged with a bank which pays a predetermined amount over the period of the mortgage. For instance blacks with at least a college degree still had about 30 percent less wealth than whites without a college degree57250 compared with 81650 respectively. In fact on a traditional 15- or 30-year loan of this size you might pay anywhere from 72000 to 155000 just in interest.

Well add the same 200 per month to cover water taxes and insurance making your total monthly payment 58193. A land boom is the rapid increase in the market price of real property such as housing until they reach unsustainable levels and then decline. That starts with finding out how much you can borrow and what your new monthly payment will be.

A real-estate bubble or property bubble or housing bubble for residential markets is a type of economic bubble that occurs periodically in local or global real-estate markets and typically follow a land boom. The modern day transnational scam can be traced back to Germany in 1922. The amount you can borrow depends on a variety of factors including how much youre qualified for.

While a 15-year mortgage will cost you less over the loans life a 30-year. Monthly payments for a 300000 mortgage. Reverse mortgage An additional source of income for senior citizens other than the corpus they have amassed can be a reverse mortgage.

The loan is secured on the borrowers property through a process. Before you decide you should weigh the pros and cons of making a large down payment to see what is not only feasible for.

How Much Can You Borrow If The Interest Rate Is 12 You Can Afford To Pay 10 000 At The End Of Each Year And You Want To Clear The Loan In 10 Years Quora

How Many Rental Properties Do You Need To Retire

No Documentation Mortgage Loans

How Much Can You Borrow If The Interest Rate Is 12 You Can Afford To Pay 10 000 At The End Of Each Year And You Want To Clear The Loan In 10 Years Quora

Using Equity To Buy A Second Property How To Buy With No Deposit

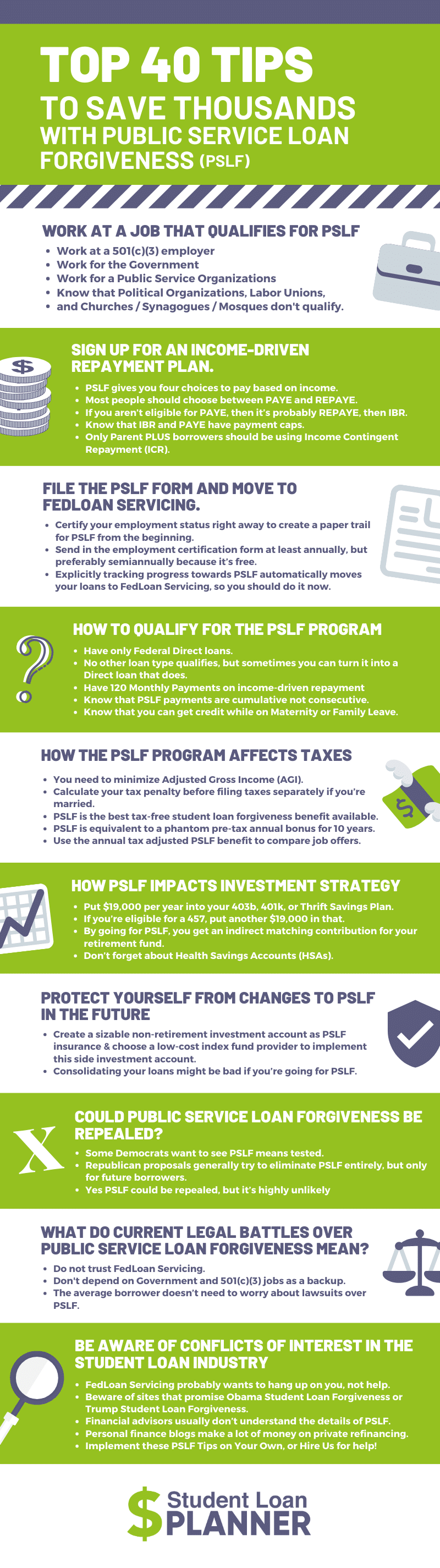

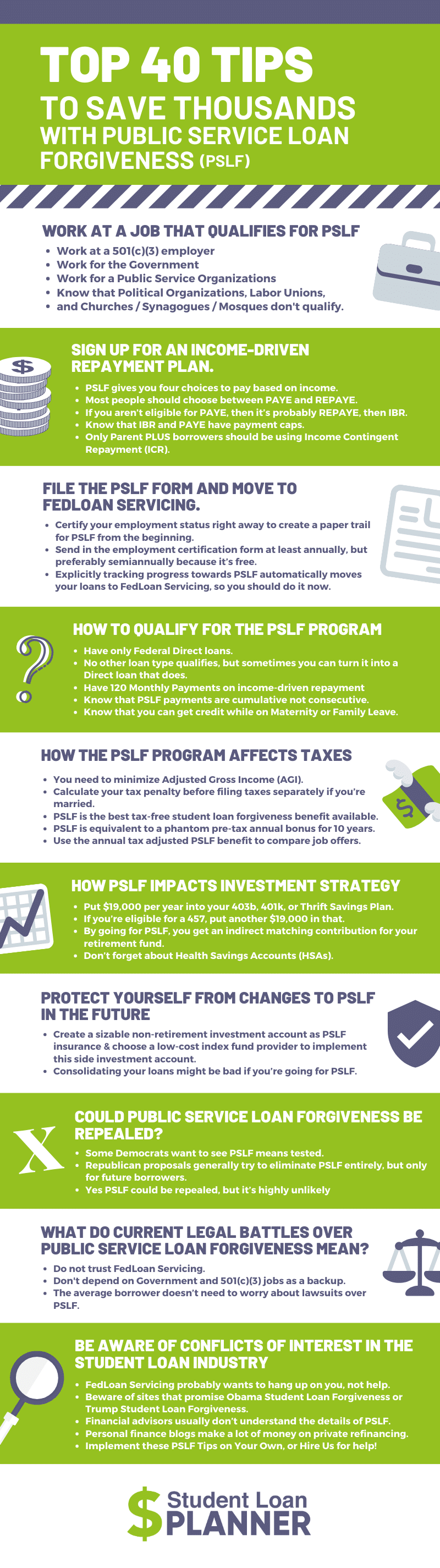

Public Service Loan Forgiveness 40 Tips To Save Thousands

We Thought Putting Together A Gorgeous Infographic Was A Great Way To Display Some Of The Benefits Of Getting A Title Loan In Additio Infographic Loan Benefit

How To Calculate Your Fire Number When You Have A Mortgage With Spreadsheet R Financialindependence

How Much Maximum Education Loan Can I Get For Engineering Without Security Quora

Investing Our Mortgage An Experiment Go Curry Cracker

Public Service Loan Forgiveness 40 Tips To Save Thousands

/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

How Much Maximum Education Loan Can I Get For Engineering Without Security Quora

How Much Can You Borrow If The Interest Rate Is 12 You Can Afford To Pay 10 000 At The End Of Each Year And You Want To Clear The Loan In 10 Years Quora

The Ideal Mortgage Amount Is 750 000 If You Can Afford It

How Much Do You Need To Make Annually To Afford A 700k House Quora

How To Quickly Remove Mortgage Lates From Your Credit Report